Category: News Alert

THE TAX APPEAL TRIBUNAL (PROCEDURE) RULES 2021

The Honorable Minister for Finance, Budget and National Planning (“the Minister”) recently issued new Tax Appeal Tribunal (Procedure) Rules 2021 (“the Rules”). The Rules were issued pursuant to the powers in Paragraph 21 of the Fifth Schedule to the Federal Inland Revenue Service (Establishment) Act, 2007. The Rules replace the 2010 Rules and are intended […]

read moreFIRS GUIDELINES ON THE TAX TREATMENT OF NGOs

INTRODUCTION The Federal Inland Revenue Service (“FIRS”) recently issued information circular no: 2021/01 (“the Circular”) for the purpose of clarifying the tax treatment of Non-Governmental Organisations (NGOs) and the application of the provisions of the Companies Income Tax Act (CITA) Cap. C21 LFN 2004 (as amended), Personal Income Tax Act (PITA) Cap.P8 LFN 2004 (as […]

read moreTETRA PAK WEST AFRICA LIMITED v. FIRS – TAX APPEAL TRIBUNAL DEFINES SALES IN THE ORDINARY COURSE OF BUSINESS AND LIMITATIONS OF THE APPLICATION OF WITHHOLDING TAX.

INTRODUCTION On 30th November 2020, the Tax Appeal Tribunal (the “Tribunal”) sitting in Lagos delivered judgment in the case of Tetra Pak West Africa Limited v Federal Inland Revenue Service with appeal number: TAT/LZ/WHT/007/2019. It defined what constitutes “ordinary course of business” for the purpose of determining withholding tax (WHT) liability. SUMMARY OF THE FACTS The appellant in […]

read moreMEGAWATTS NIGERIA LIMITED V. REGISTERED TRUSTEES OF GBAGADA PHASE II RESIDENTS’ ASSOCIATION – A CASE REVIEW & THE POSSIBLE IMPLICATIONS ON ESTATE RESIDENTS

INTRODUCTION As a form of strategy for the co-ordination of monetary liability for shared utilities such as power, waste management, security etc. and overall maintenance of estate’s facility, it is not unusual for developers of residential estates and residential communities alike to make membership of estate associations mandatory for residents. As a matter of fact, […]

read moreHIGHLIGHTS OF THE NEW COMPANIES AND ALLIED MATTERS ACT 2020

INTRODUCTION The signing of the Companies and Allied Matters Act, 2020 (“CAMA, 2020”) into law by President Muhammadu Buhari on the 7th of August, 2020 rides on the successful enactment of the Finance Act which fundamentally repositions Nigeria tax legislations and the enactment of the Federal Competition and Consumer Protection Act of 2019 which represents […]

read moreFIRS ISSUES PUBLIC NOTICE ON THE VAT MODIFICATION ORDER 2020

On the 24th of June, 2020, the FIRS issued a public notice to the effect that the following items stated in the VAT Modification order as VAT exempt are still subject to VAT. They include: • natural gas; • materials for pharmaceutical products; • renewable energy equipment; and • materials for baby diapers & sanitary […]

read more

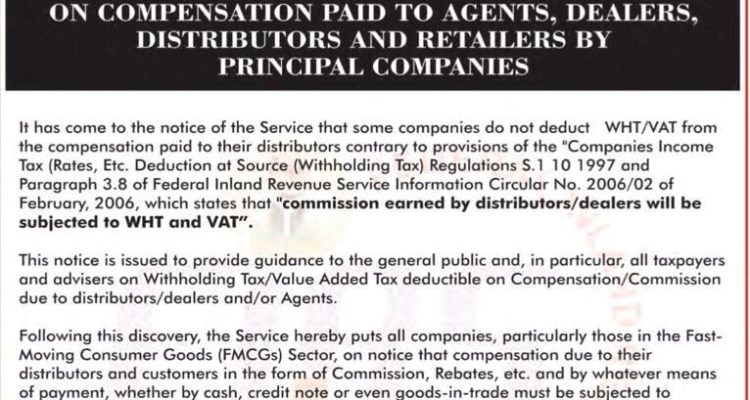

FIRS Demands Companies to Withhold Value Added Tax (VAT)/Withholding Tax (WHT) Deductible on Compensation/Commission due to Distributors /Dealers and/or Agents.

On the 14th of August 2019, The Federal Inland Revenue Service (FIRS) issued a public notice reminding all companies to ensure they remit their Value Added Tax (VAT) and Withholding Tax (WHT) by the 21st day of every month. The notice which was signed by the FIRS Chairman noted that companies particularly in the […]

read moreFEDERAL GOVERNMENT RECONSTITUTES TAX APPEAL TRIBUNAL

On Thursday the 12th of July 2018, the Federal Government of Nigeria, in accordance with Section 2(1) of the Fifth Schedule of the Federal Inland Revenue Service Establishment Act, announced the reconstitution of the Tax Appeal Tribunals (TAT) in the six geo-political zones in the Country including Lagos and the Federal Capital Territory, Abuja. The […]

read more